How 2A/2B Reconcile Tool Works ?

-

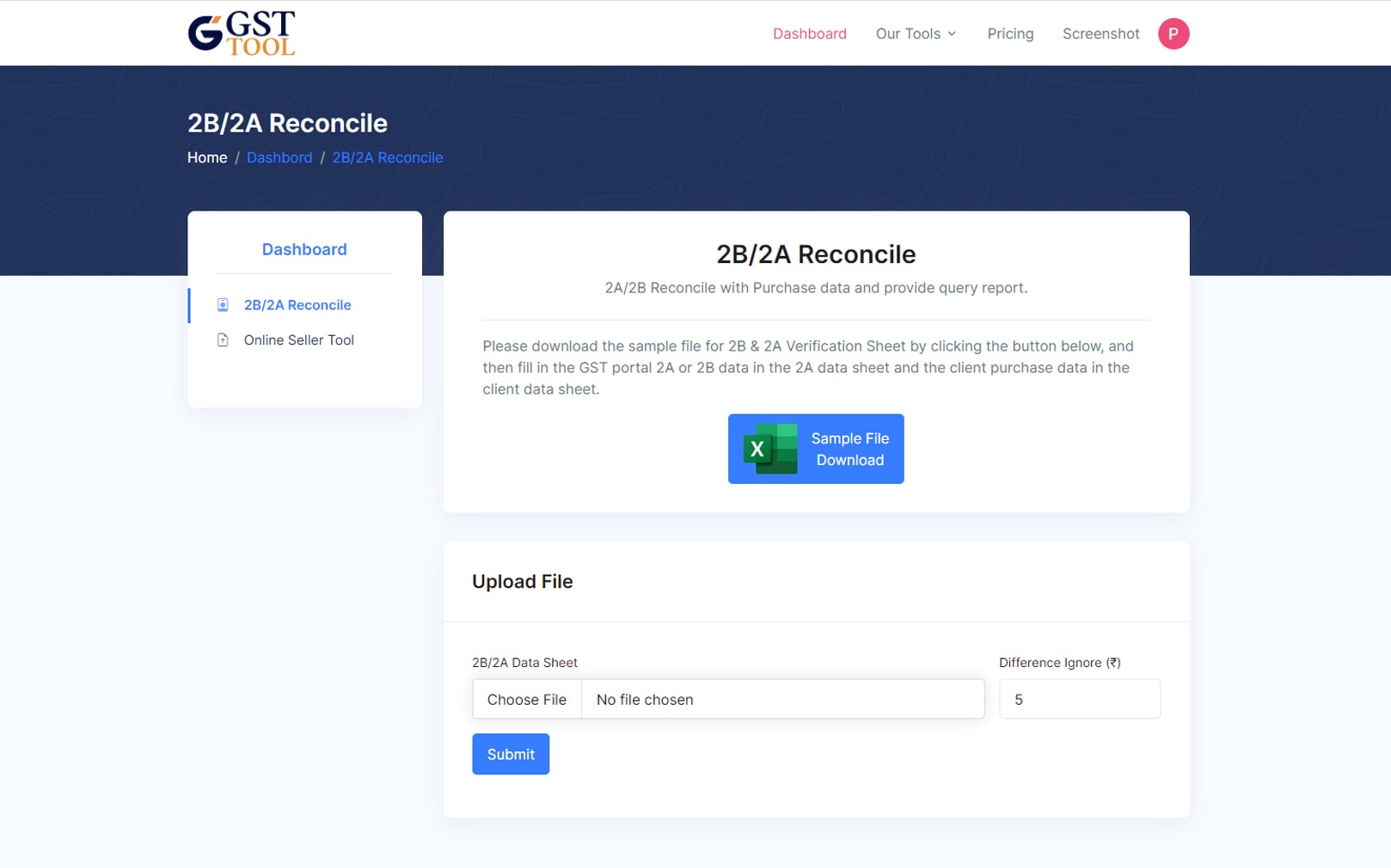

Create Sample File and Upload

Download our sample file, fill in the 2A/2B and purchase data, and upload the file to our system.

-

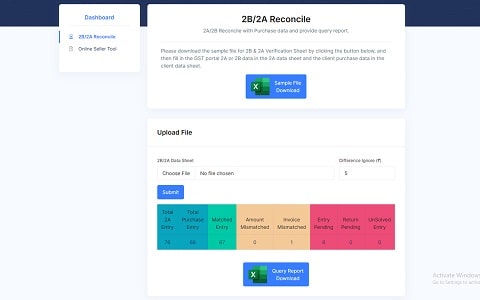

Process Data

After uploading the sample file, click on the 'Process' button and our system will check every bill for queries and mismatched invoices.

-

Download Report

After the process is complete, you can download a report in Excel format that includes details for every invoice query.

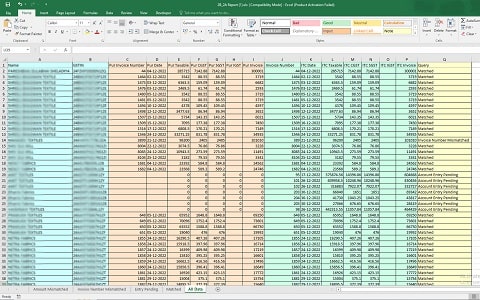

Comprehensive Details Included in Excel Report

- Amount Mismatched

- Invoice Number Mismatched

- Account Entry Pending

- Return Pending

- Matched Entry

- All Entry

Excel Report

The data is categorized into different tabs, making it easy for you to check. In case you want to filter the data yourself, the 'all entry' tab contains all data with query details.

Here is a screenshot of our tool

To get a better idea of the look and feel of our tool, take a look at this sample screenshot.

Upload Data

Process

Downloaded Report

Frequently Asked Questions

Does this tool work on 2A or 2B?

Our tool is compatible with both 2A and 2B, but you'll need to check the purchase data for each one separately.

Can i use GST portal 2A/2B Excel file directly?

Currently, we only accept sample files as input, but we're working on adding the ability to upload gst.gov.in 2A/2B files directly to our system soon.

What if 2A/2B have same invoice 2 time?

Out tool check each invoice individually. If the same invoice is listed twice in both 2A and 2B, one invoice will be marked as matched and the other will be listed in the 'entry pending' tab.

How can I add credit notes in the sample file?

If you want to add a credit or debit note, you can do so by adding it to the sample file with a negative value for credit notes and with corresponding debit and credit notes.